Published: 02 December, 2025

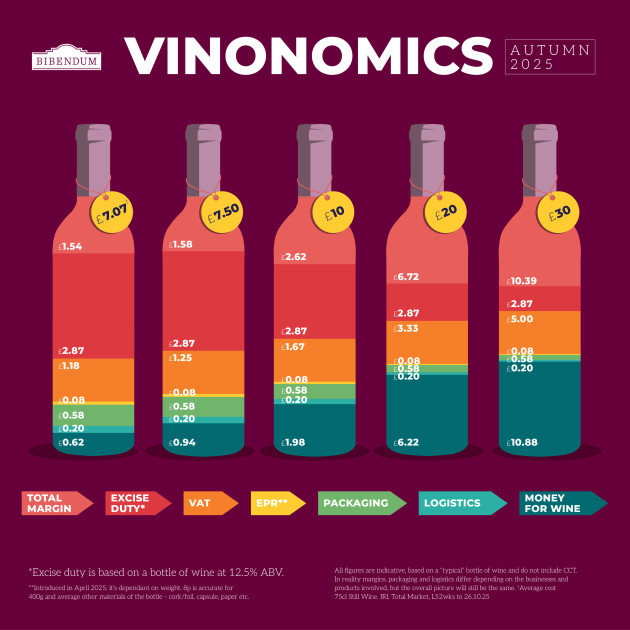

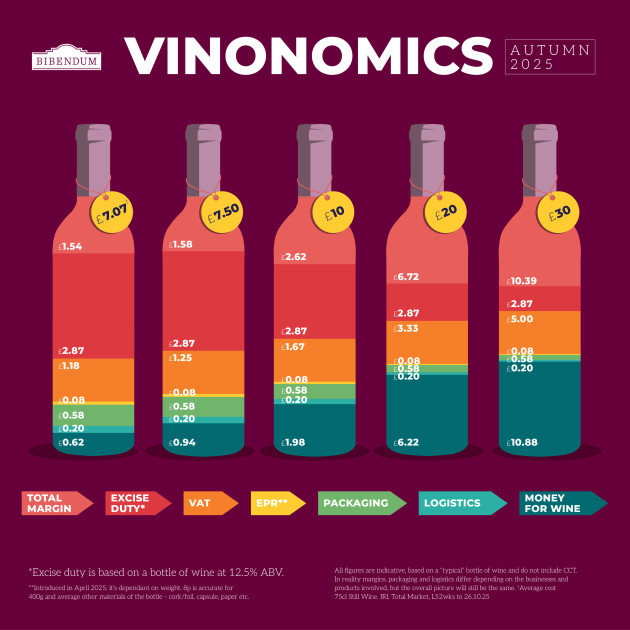

The premium wine distributor Bibendum has released a new ‘Vinonomics’ graph (pictured) which breaks down the different costs that make up the price of a bottle of wine, following the Autumn Budget.

Read more...

|

A new survey from the Scotch Whisky Association (SWA) can reveal that three out of four whisky companies expect to defer investment (or invest outside of the UK) due to the high tax burden upon them.

Read more...

Published: 27 March, 2025

The trade has expressed its disappointment that no relief for businesses will be forthcoming via Rachel Reeves’ Spring Statement, as the industry continues to face a roster of tax hikes from the last Autumn Budget.

Read more...

Published: 11 November, 2024

Leading members of the UK's hospitality sector have written to the Chancellor, warning of “business closures, job losses and cancelled investment” unless immediate action is taken.

Read more...

Published: 01 November, 2024

The Autumn Budget’s employment tax measures will raise the cost of employing full-time staff by at least £2,500, according to an analysis released by UKHospitality.

Read more...

Published: 23 September, 2024

Wine and spirit businesses are calling on the government to freeze alcohol duty for at least two years, arguing it will help offset declining revenues and support public finances.

Read more...

Published: 09 August, 2022

According to new YouGov research, over three-quarters of Tory party members want tax on wine to be frozen at its current rate or reduced.

Read more...

Published: 19 October, 2021

Reports from the national press suggest that the premium on sparkling wine duty could be scrapped by chancellor Rishi Sunak in the upcoming Autumn Budget in a move which could bring sparkling wine duty in line with still.

Read more...

Published: 12 October, 2021

Britain’s gin makers are calling on Chancellor Rishi Sunak to freeze spirit duty and extend hospitality’s VAT cut to alcoholic drinks to help boost British business.

Read more...

Published: 10 September, 2018

The Scotch Whisky Association (SWA) has called on the UK government to support the industry at home through a continued duty freeze in the Autumn Budget.

Read more...